What the August report shows

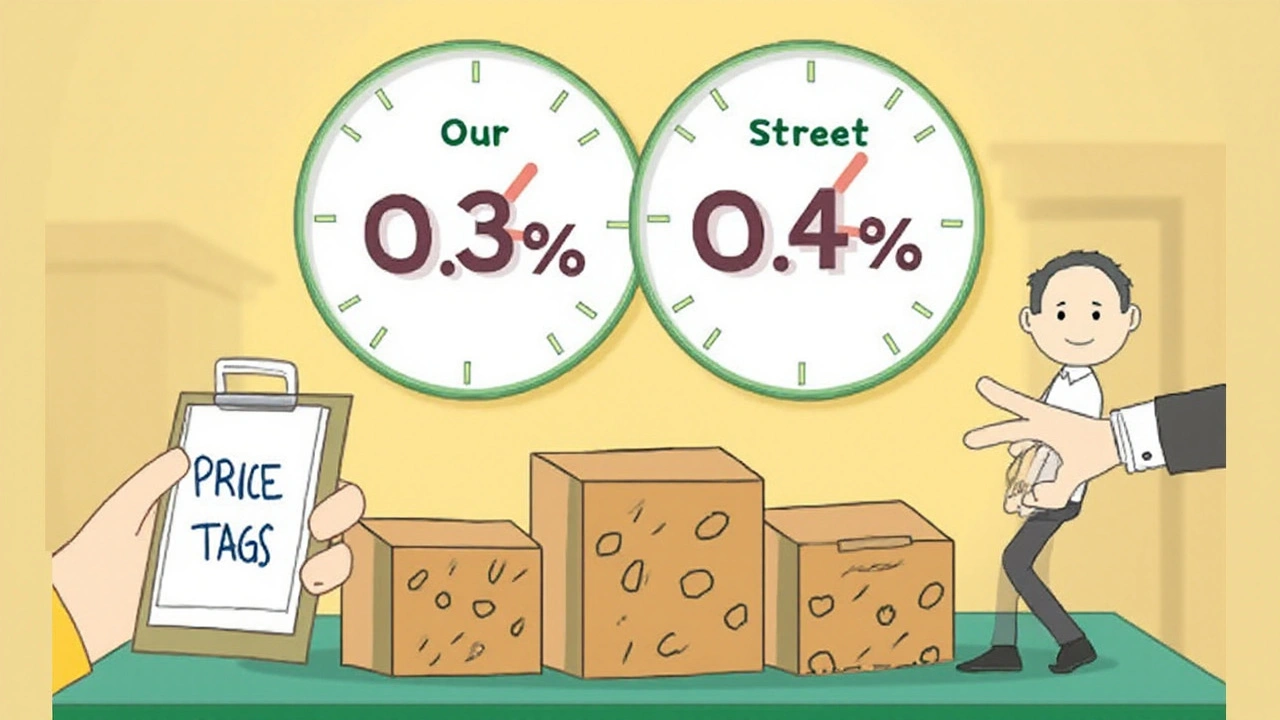

Here’s a curveball for inflation watchers: the US PPI fell 0.1% in August from July, a clean miss against economists’ expectations for a 0.3% rise. On a yearly basis, producer prices slowed to 2.6%, down from a downwardly revised 3.1% in July and well below the 3.3% consensus. For a data series that often surprises, this one still stood out.

The miss wasn’t just about forecasting error. The Labor Department’s details point to a clear driver: services prices slid 0.2% as margins at wholesalers and retailers narrowed. That matters because the PPI’s “trade services” component tracks margins, not sticker prices. When margins compress, it can signal businesses are eating higher input costs rather than passing them through to customers.

Core producer prices—excluding food and energy—also edged down 0.1% on the month and rose 2.8% over the year. Both figures undershot expectations, reinforcing the idea that pipeline inflation pressure cooled broadly in August rather than being a one-off quirk in energy or food.

Ahead of the release, the risk of a surprise was telegraphed. A Reuters survey of 24 forecasters showed a wide spread for the annual rate—from 2.8% to 3.6%—a reminder of how jumpy producer price data can be month to month. Even so, most penciled in a repeat of July’s 3.3% annual pace, which didn’t materialize.

The services margin story ties directly into the tariff debate. With President Donald Trump’s broader import tariffs in place, many expected faster producer price inflation as costs filtered through. That hasn’t hit full force. Stephen Brown at Capital Economics summed it up bluntly: tariff effects are feeding through only slowly. Bill Adams, Comerica Bank’s chief economist, pointed to several reasons: foreign suppliers discounting to keep share in the U.S., soft domestic demand, and companies simply waiting to see where tariff rates settle before moving list prices.

That doesn’t mean import-sensitive categories were quiet across the board. Coffee jumped 6.9% in August and is up 33.3% over the year—an example of how specific supply chains can buck the broader cooling trend. Still, goods price gains like that were not enough to offset the pullback in services margins.

Markets took the report in stride. EUR/USD barely budged after an initial pop, gold slipped around 0.15%, and Dow futures were almost flat ahead of the opening bell. The message from traders: notable data surprise, limited immediate investment implications.

The monthly swing also comes after a hot July, when headline PPI rose 0.7%. The August reversal suggests some of that summer heat was transitory. It’s common for producer prices to whipsaw as energy, shipping, and margin dynamics move in different directions from one month to the next, and as companies tweak pricing in response to demand signals.

Zooming out, projections suggest the cooldown might not last indefinitely. Trading Economics expects producer prices to settle near 3.00% by quarter-end. Their econometric models point to a slow drift toward 2.8% in 2026 and 2.7% in 2027—levels that would be consistent with a modest inflation backdrop rather than a fresh price spike.

What it means for businesses, consumers, and policy

PPI is often described as a pipeline indicator—the prices businesses receive before goods and services reach consumers. It isn’t a carbon copy of CPI, but a cooler PPI reading can ease the pressure on consumer inflation if companies keep absorbing costs or if input prices continue to settle. August suggests exactly that: retailers and wholesalers, for now, are taking the hit.

Absorbing costs isn’t free. When margins compress, companies face tougher choices on promotions, hiring plans, and capital spending. Weaker pass-through today can mean more catch-up pricing later if costs stay elevated. Alternatively, if demand remains soft or competition stays intense, businesses may keep trimming margins to hold market share—positive for consumers in the short run, painful for earnings.

Tariffs remain the big wild card. In theory, broad import levies raise costs and ultimately lift prices. In practice, the speed and size of the pass-through depend on global competition, currency moves, and buyer power. Foreign suppliers cutting prices to stay in the U.S. market soften the blow. So does a consumer who pushes back on higher tags. The August numbers suggest that mix is still restraining inflation, with more of the burden falling on corporate profits than on household budgets.

Services are the swing factor. Unlike goods, where commodity costs and shipping can dominate, services inflation leans heavily on wages, margins, and productivity. A 0.2% drop in services margins hints at competitive pressure and possibly slower demand. If that continues, it could keep a lid on CPI services in the months ahead. But it can also reverse quickly if firms regain pricing power or if wage growth forces their hand.

One reason for caution: PPI can be noisy. The same “trade services” category that pulled August down can rebound if retailers unwind discounts or if wholesale markups normalize into the holiday season. That’s why forecasters often track three-month and six-month trends to smooth the noise. With July hot and August cool, September will tell us whether the downshift has legs.

Category details also matter. Coffee’s surge hints at commodity-specific stories—weather hits to crops, supply disruptions, or currency swings—that don’t map neatly onto the broader inflation narrative. You can get pockets of price pressure at the same time the aggregate eases. For companies with narrow margins in food and beverage, those pockets are decisive for earnings even if headline inflation looks tame.

For the policy debate, a softer PPI tempers near-term price worries but doesn’t answer the bigger questions. Has tariff-related pass-through been delayed or diluted? Will businesses try to rebuild margins later in the year? Does weakening demand hold them back? Policymakers and investors will be watching the services margins line especially closely—if it stabilizes, PPI could drift back toward that 3% area projected by models.

There’s also the timing. The next PPI print lands on Thursday, October 16, 2025, at 8:30 a.m. ET. With markets unconvinced by a one-month dip, September’s report takes on added weight. A second soft print would strengthen the case that inflation pressures in the production pipeline are fading. A bounce would reopen the door to sticky price pressures into year-end.

For businesses, the playbook is straightforward but hard: keep negotiating with suppliers, protect margins without alienating customers, and stay flexible on pricing. For consumers, the August report is a quiet win—less evidence that tariffs are raising shelf prices broadly, at least for now. For investors, it’s a reminder to look under the hood: services margins, core trends, and commodity quirks are doing the real work behind the headline number.

One last note on uncertainty. The wide range in the Reuters poll—2.8% to 3.6% on the annual rate—speaks to how fragmented the signals are across sectors. With some import prices rising sharply and others being offset by discounts, the aggregate can move in unexpected ways. That’s why August’s negative surprise shouldn’t be overread—but it also shouldn’t be ignored. It tells us companies are still fighting to balance costs, prices, and demand in a tariff-heavy world.

Bottom line for the months ahead: watch whether services margins stabilize, whether core PPI stops slipping, and whether commodity hotspots like coffee remain isolated. If those threads hold, producer prices may hover near the 3% neighborhood by quarter-end, as models suggest. If not, brace for more chop—and more surprises—before the year is out.

Shelby Mitchell

September 13, 2025 AT 05:14PPI down 0.1%? Weird. But also kinda expected.

Morgan Skinner

September 13, 2025 AT 17:11This is exactly why we need to stop treating monthly PPI data like gospel. The trade services component is the real story here-margins are getting squeezed because businesses are choosing to absorb costs rather than pass them on. That’s not inflation cooling. That’s corporate profit erosion in slow motion. And if demand stays soft, this could become a new normal. Not because prices are falling, but because companies are too scared to raise them.

It’s a quiet kind of economic stress. No headlines, no panic, just a thousand small decisions by retailers and wholesalers to keep shelves stocked and customers happy-even if it means eating into their own bottom lines. We’re not seeing disinflation. We’re seeing survival mode.

Rachel Marr

September 14, 2025 AT 09:16Honestly, I’m glad businesses are eating the cost instead of raising prices. My grocery bill’s already brutal enough. If this means my coffee doesn’t jump another $2 next month, I’ll take it. Hope it lasts.

Kasey Lexenstar

September 14, 2025 AT 14:24Oh wow. The economy’s collapsing. Next you’ll tell me the moon landing was faked. PPI down? In a world where tariffs are being slapped on everything from coffee to steel? Yeah, right. Someone’s cooking the books. Or maybe the Fed’s got a new algorithm that just says ‘cool’ whenever inflation gets too loud.

Trevor Mahoney

September 15, 2025 AT 07:27Let me break this down for you people who don’t read the footnotes. The PPI drop isn’t real. It’s a distraction. The real inflation is happening in the shadows-supply chains are being rerouted through third countries to dodge tariffs, and those goods are still getting marked up, just not in the official data. The Labor Department’s numbers are like a mirror in a funhouse: everything looks distorted because they’re only measuring what the system wants you to see. And who controls the system? The same banks that own the Fed. This isn’t a cooling economy. It’s a controlled burn. They’re letting the surface cool so the fire underneath doesn’t get noticed until it’s too late. The coffee spike? That’s the canary. And it’s screaming.

Jitendra Patil

September 15, 2025 AT 19:17American businesses are weak. They can’t even pass on a few cents to customers? In India, if the cost of sugar goes up, the chaiwallah raises the price the same day. No hesitation. No ‘waiting to see’. That’s why we’re building our own supply chains. While you guys debate margins, we’re building factories. Your ‘soft demand’? That’s just laziness. You’re not competing-you’re begging.

Michelle Kaltenberg

September 16, 2025 AT 05:57I just want to say-this is why we need to support small businesses. The fact that retailers are absorbing these costs instead of hiking prices is a quiet act of heroism. They’re choosing community over profit. And yet, no one’s writing op-eds about them. No one’s giving them a parade. Just a cold, clinical PPI report that reduces their sacrifice to a percentage point. We owe them more than data points. We owe them gratitude.

Jared Ferreira

September 16, 2025 AT 15:34So if margins are shrinking, does that mean companies are making less money? And if they make less, do they hire less? That’s the real question. Not whether coffee got more expensive.

Kurt Simonsen

September 17, 2025 AT 09:26PPI down? 😏😂 LMAO. The Fed’s been whispering to the data for months. You think this is natural? Nah. It’s a soft landing illusion. They’re playing 4D chess while the rest of us are stuck playing checkers. Mark my words-when the next report drops and it’s up 0.8%, everyone’s gonna act like they saw it coming. But no one did. Not really. We’re being led by the nose. 🐄📉

mona panda

September 17, 2025 AT 09:46ppl act like this is a surprise. tariffs don't magically make stuff cheaper. they just make the middlemen cry. same thing every time.

Evangeline Ronson

September 18, 2025 AT 03:57What’s fascinating here is how this reflects a broader global shift. When foreign suppliers discount to stay in the U.S. market, it’s not just about competition-it’s about adaptation. It’s a sign that globalization isn’t dead, it’s evolving. Companies aren’t just reacting to tariffs; they’re re-engineering their value chains, negotiating with new partners, and finding creative ways to survive. That’s resilience. And it’s happening quietly, without fanfare. The real story isn’t in the headline-it’s in the supply chain whispers.

Cate Shaner

September 18, 2025 AT 18:30Ah yes, the classic ‘core PPI’ sleight of hand. Exclude food and energy? Sure. Because those are the only things normal people buy. Meanwhile, your ‘trade services’ margin compression is just corporate welfare dressed up as deflation. You’re not seeing disinflation-you’re seeing a temporary pause before the inevitable repricing cycle kicks in. And when it does, it’ll be brutal. Because the cost of capital, labor, and logistics didn’t disappear. It just got deferred. And deferred debt always comes due.

Thomas Capriola

September 19, 2025 AT 02:09They’re lying. The data’s cooked. Everyone knows it.

Rachael Blandin de Chalain

September 19, 2025 AT 15:41The persistence of margin compression in trade services suggests a structural adjustment rather than a cyclical fluctuation. This may indicate a longer-term recalibration of pricing power dynamics between producers, distributors, and consumers in an environment of heightened trade uncertainty and subdued aggregate demand. Further analysis of sectoral breakdowns, particularly in durable goods and non-durable retail, would be warranted to assess the durability of this trend.

Soumya Dave

September 20, 2025 AT 00:11This is the kind of moment that separates the strong from the weak. Companies that adapt-by innovating, by cutting waste, by building better relationships with suppliers-are the ones who will thrive. This isn’t a crisis. It’s a test. And the ones who panic and raise prices are the ones who’ll lose customers. The ones who stay calm and find smarter ways to operate? They’ll come out stronger. This is our chance to build something better-not just survive it.

Chris Schill

September 20, 2025 AT 15:26I’ve been watching the coffee prices for months. That 33% jump? That’s the real inflation. Everything else is noise. If you’re running a small café, that’s your whole business. No one talks about that. But it’s what matters to real people.