Inflation Explained: What It Means for You

Inflation is the term we hear every time groceries get costlier or fuel prices jump. In simple words, it means the buying power of your money is shrinking because prices are going up across the board.

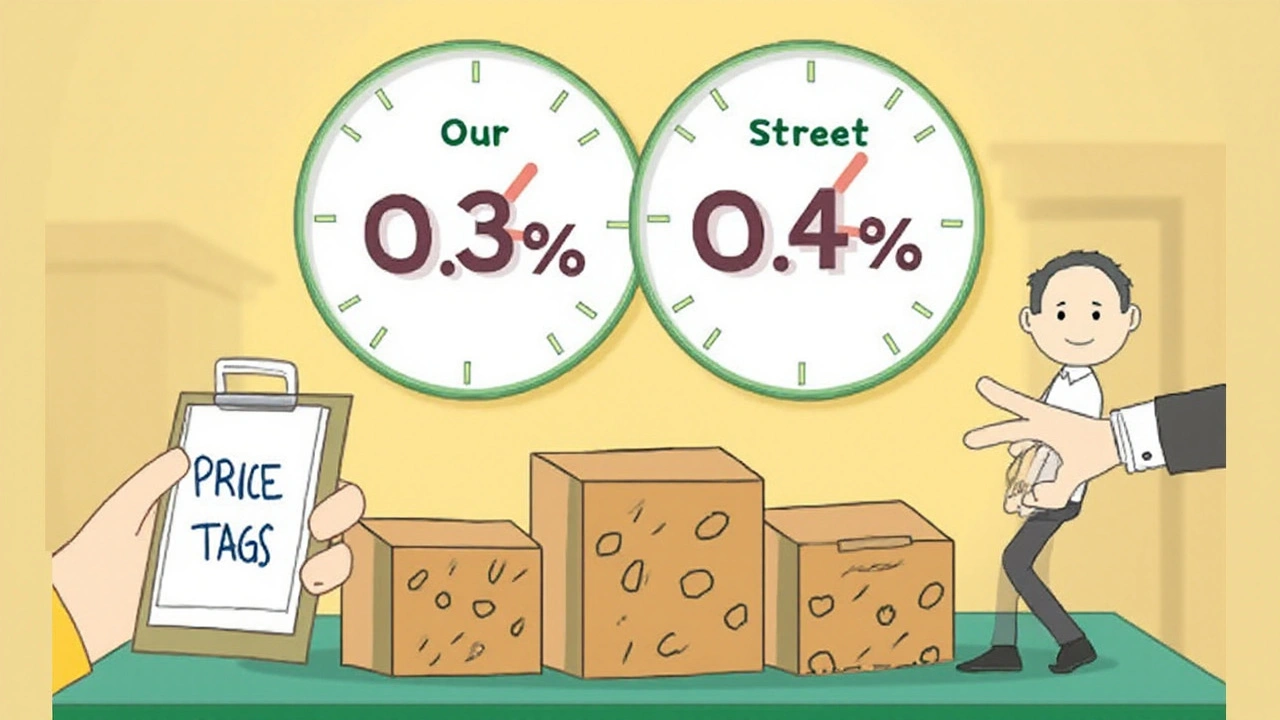

There are a few main reasons why this happens. First, when demand for goods outpaces supply, sellers raise prices to balance the market. Second, higher production costs—like wages, raw materials, or energy—push companies to pass those costs onto shoppers. Finally, central banks can affect inflation by changing interest rates or printing more money, which can flood the economy with cash and lift prices.

Why Prices Keep Going Up

Think about a popular smartphone launch. Everyone wants it, but the factories can only make a limited number. The scarcity forces the price up. The same idea works for food, housing, and even services. When a country imports a lot of fuel and the global oil price spikes, the cost of transportation rises, and that extra expense shows up on the price tag of everything you buy.

Another driver is the wage-price spiral. Workers notice higher living costs and demand more pay. If businesses grant those raises, they often need to increase prices to cover the extra labor expense, which can start the cycle over again.

Practical Ways to Beat Inflation

While you can’t stop the economy from inflating, you can shield your wallet. Start by tracking your spending. Knowing where your money goes helps you cut unnecessary costs. Look for discounts, bulk deals, or store brands that offer the same quality for less.

Consider budgeting for a “price‑rise buffer.” Put a little extra aside each month so you’re prepared if your bills climb. If you have savings, think about moving a portion into assets that historically outpace inflation, like real estate or certain stocks.

Another tip is to lock in prices when you can. For example, signing a longer‑term lease for a home or an insurance policy can protect you from sudden hikes. Also, keep an eye on interest rates. If they’re low, refinancing a loan can lower your monthly outgoings.

Lastly, stay informed. Reading reliable news sources about inflation trends helps you anticipate changes and act before they bite. Understanding the basics of why prices rise gives you a clearer picture of what to expect and how to respond.

Inflation might feel like a constant headache, but with a few smart habits you can keep its impact manageable. Keep tracking, stay flexible, and use any extra cash to invest in things that grow faster than prices. That way, your money works for you, even when the cost of living tries to catch up.