What Are Producer Prices and Why They Matter

Producer prices are the amounts manufacturers and wholesalers charge for goods before they reach retailers. In other words, they’re the cost of making or buying a product at the factory gate. When these prices go up, the extra cost usually moves down the supply chain and ends up in the price you pay at the store.

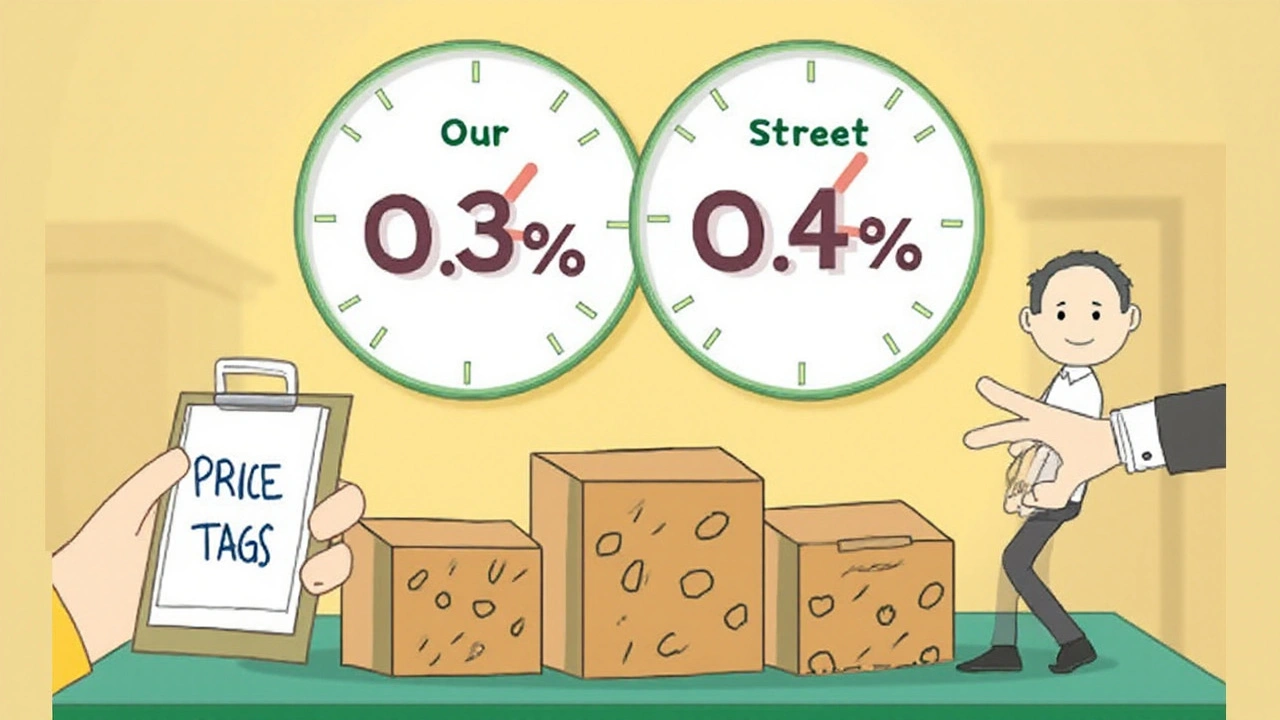

Governments track producer prices with a Wholesale Price Index (WPI) or Producer Price Index (PPI). The data shows how much the price of raw materials, intermediate goods, and finished products changes over time. This information helps economists predict future inflation and lets businesses plan their budgets.

How Producer Prices Influence Inflation

Inflation means the overall price level rises, and producer prices are a key driver. If the cost of steel, copper, or oil jumps, manufacturers face higher expenses. To keep profits, they often raise the price of the final product. Those higher retail prices feed into the Consumer Price Index (CPI), which measures inflation that consumers feel.

Because producer prices move before consumer prices, analysts watch the PPI closely. A sudden spike in the PPI can signal that inflation will pick up in the next few months. Central banks use this insight when deciding whether to raise or lower interest rates.

Practical Tips for Businesses and Consumers

If you run a small business, monitor producer price trends for the goods you buy. Websites of statistical agencies usually publish monthly PPI reports. Spotting a steady rise in the cost of your main inputs can give you time to negotiate better contracts, look for alternative suppliers, or adjust your pricing strategy before customers notice.

Consumers can also benefit. When you hear news about rising producer prices for things like food or fuel, expect grocery and gas bills to go up soon. Planning larger purchases ahead of a price hike can save money. For example, buying a pantry of canned goods before a reported increase in agricultural producer prices can keep your grocery budget in check.

Finally, remember that not every change in producer prices passes to consumers. Some industries absorb cost increases to stay competitive, while others have enough margin to add a small surcharge. Understanding the specific market you’re dealing with helps you gauge how much of the producer price change will affect you directly.

In short, producer prices are the first sign of cost pressure in the economy. Keeping an eye on them gives businesses a chance to act early and helps consumers anticipate price shifts. Whether you’re a shop owner, a finance student, or just curious about why your grocery bill jumps, watching the PPI can provide valuable clues about the direction of the economy.