Tariffs Explained: How Taxes on Trade Affect You

Ever wonder why the price of a smartphone from abroad seems higher than you expected? Chances are a tariff is part of the story. A tariff is a tax that a government adds to goods coming in from another country. It’s a tool that can protect local jobs, raise revenue, or push other nations to change their trade rules. The key thing to know is that a tariff usually ends up in the pocket of the buyer, not the seller.

Why Governments Use Tariffs

Governments have three main reasons for slap‑on‑a‑tariff. First, they want to protect local industries. If a foreign factory can sell shoes for half the price of a domestic one, a tariff makes the foreign price rise, giving the local workers a chance to stay competitive. Second, tariffs generate money for the state budget. Even a small percentage on high‑value items can add up quickly. Third, they act as leverage in negotiations. When a country feels another is playing unfair, a tariff can be a bargaining chip to get better market access or enforce labor standards.

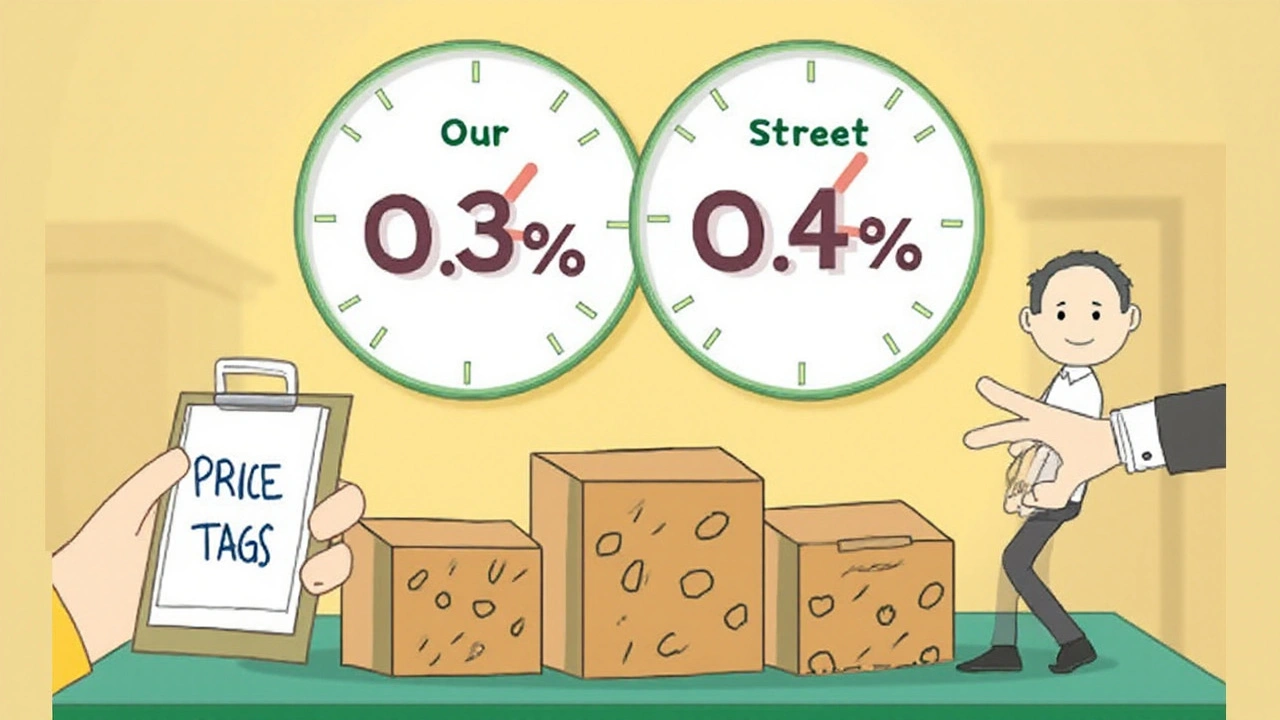

How Tariffs Impact Everyday Prices

When a tariff is added, the importer normally pays it at the border. To stay in business, they raise the price you see on the shelf. That’s why a pair of jeans made in Bangladesh might cost more in South Africa after a 15% duty is applied. The effect is not limited to clothing; it stretches to food, electronics, cars, and even building materials. If you’re a small business owner, tariffs can squeeze your profit margins or force you to find new suppliers.

Consumers often feel the pinch first, especially on goods that don’t have many local alternatives. However, not every product is hit equally. Some countries have free‑trade agreements that wipe out tariffs on certain items. Others use exemptions for essential goods like medicine or food staples to keep basic costs down.

Understanding tariffs can help you make smarter choices. If you see a price jump on a product you love, check whether a new tariff was introduced. Sometimes the same item is available from a different source with a lower duty. Knowing the rules can also help businesses plan inventory better—buying in bulk before a scheduled tariff increase can save money.

In recent years, global trade tensions have led to rapid tariff changes. The U.S.-China trade war, for instance, saw dozens of product categories hit with extra duties, causing ripples worldwide. South African importers felt higher costs on electronics and steel, which then filtered down to consumers.

So, what can you do? Stay informed by following news on trade agreements and tariff announcements. If you run a business, work with customs brokers who can advise on duty rates and possible exemptions. For everyday shoppers, compare prices from different retailers—sometimes a local alternative avoids the tariff entirely.

In short, tariffs are a tax on imported goods that influence prices, jobs, and international relations. They’re not always bad, but they do change the math for anyone buying or selling across borders. Knowing the basics helps you spot why a price moved and what steps you might take next.