US PPI Explained – Why It Matters

When you hear talk about inflation, the Producer Price Index (PPI) often pops up. It’s the number that shows how much producers are paying for goods before those costs reach you, the consumer. In short, it’s a early warning sign for price changes that will later show up in your grocery bill or fuel price.

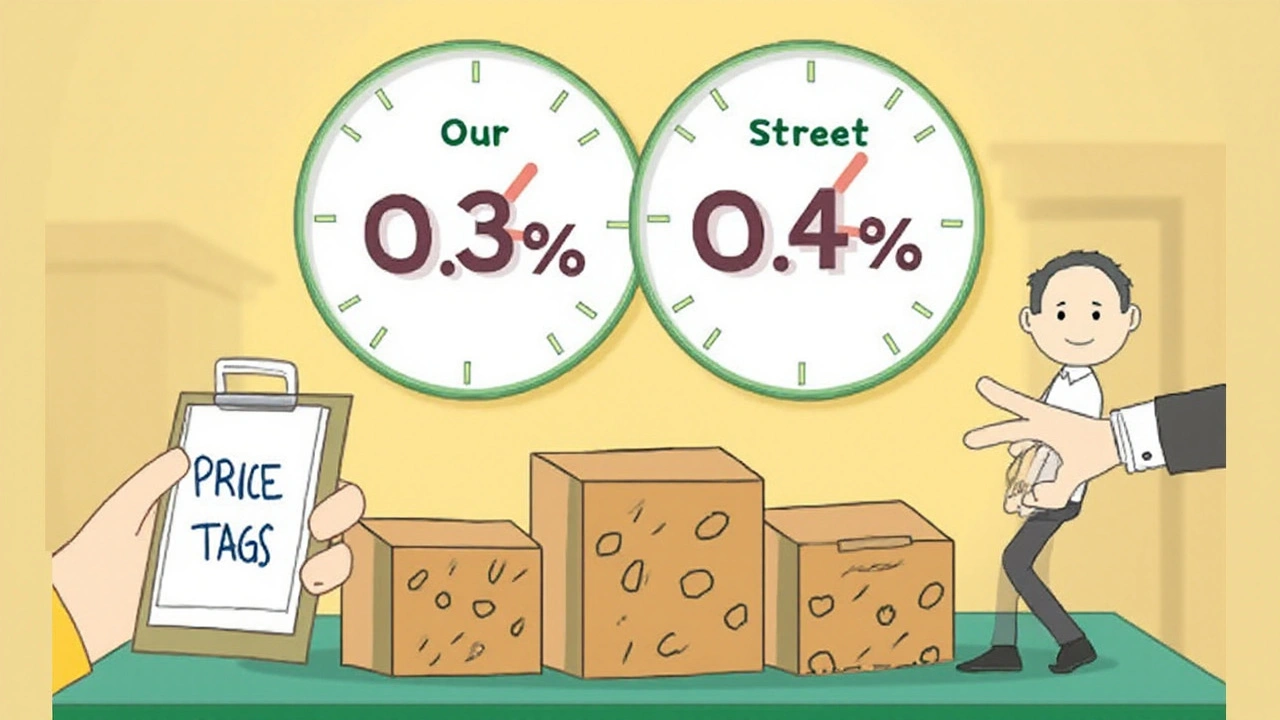

Because the US PPI tracks wholesale prices, it moves ahead of the more familiar Consumer Price Index (CPI). If producers are paying more today, chances are retailers will raise prices in the near future. That makes the PPI a key tool for investors, policymakers, and anyone trying to gauge the health of the economy.

How the US PPI Is Calculated

The Bureau of Labor Statistics (BLS) collects thousands of price points each month from manufacturers, miners, and wholesalers across a wide range of industries. They group these into categories like finished goods, intermediate goods, and raw materials. Each category gets a weight based on its share of total production, and the BLS combines them into a single index.

A rise in the index means producer prices are up; a drop means they’re down. The BLS releases the numbers about 10 days after the month ends, so you get a pretty fresh snapshot of price pressure in the economy.

How to Use US PPI Data

If you’re an investor, look at the PPI trend to anticipate moves in stocks, bonds, and commodities. A consistently rising PPI often leads to higher interest rates, which can push bond yields up and stock valuations down. On the flip side, a falling PPI may signal easing inflation and give the Federal Reserve room to keep rates low.

Businesses use the PPI to set pricing strategies and negotiate contracts. Knowing that raw material costs are climbing, a manufacturer might lock in long‑term supplier deals now to avoid future hikes.

Everyday people can also benefit. When the PPI spikes, expect higher costs for things like gas, food, and home goods in the weeks that follow. Planning purchases or budgeting around those cycles can save you money.

To stay on top of the US PPI, sign up for BLS alerts or follow reputable financial news sites. The data is free, and the monthly release is quick to digest. Combine it with other indicators—like CPI, unemployment, and Fed statements—to get a fuller picture of where the economy is headed.

Bottom line: the US PPI is more than a number in a report. It’s a glimpse into the supply chain’s cost pressure that eventually rolls over to your wallet. Understanding it helps you react faster, whether you’re trading stocks, running a business, or just planning your monthly budget.